Trust funds are legal entities you create to determine how your estate is distributed to beneficiaries. They offer more flexibility than wills. You can plan for them to go into effect during your lifetime or at death, and you can also control how the beneficiary uses the funds and any behavior that would impede inheritance.

Picking the best trust fund requires that you set clear goals. Determining why you are creating the trust and who the beneficiaries are is essential. Other factors to consider are how permanent your decision is and whether the beneficiary is a child, a grandchild, a firm, or a charitable organization.

Legally, the person who sets up and funds a trust is the grantor (or trustor), the trustee manages it and distributes the assets, and the recipient is the beneficiary.

How Are Trust Funds Classified?

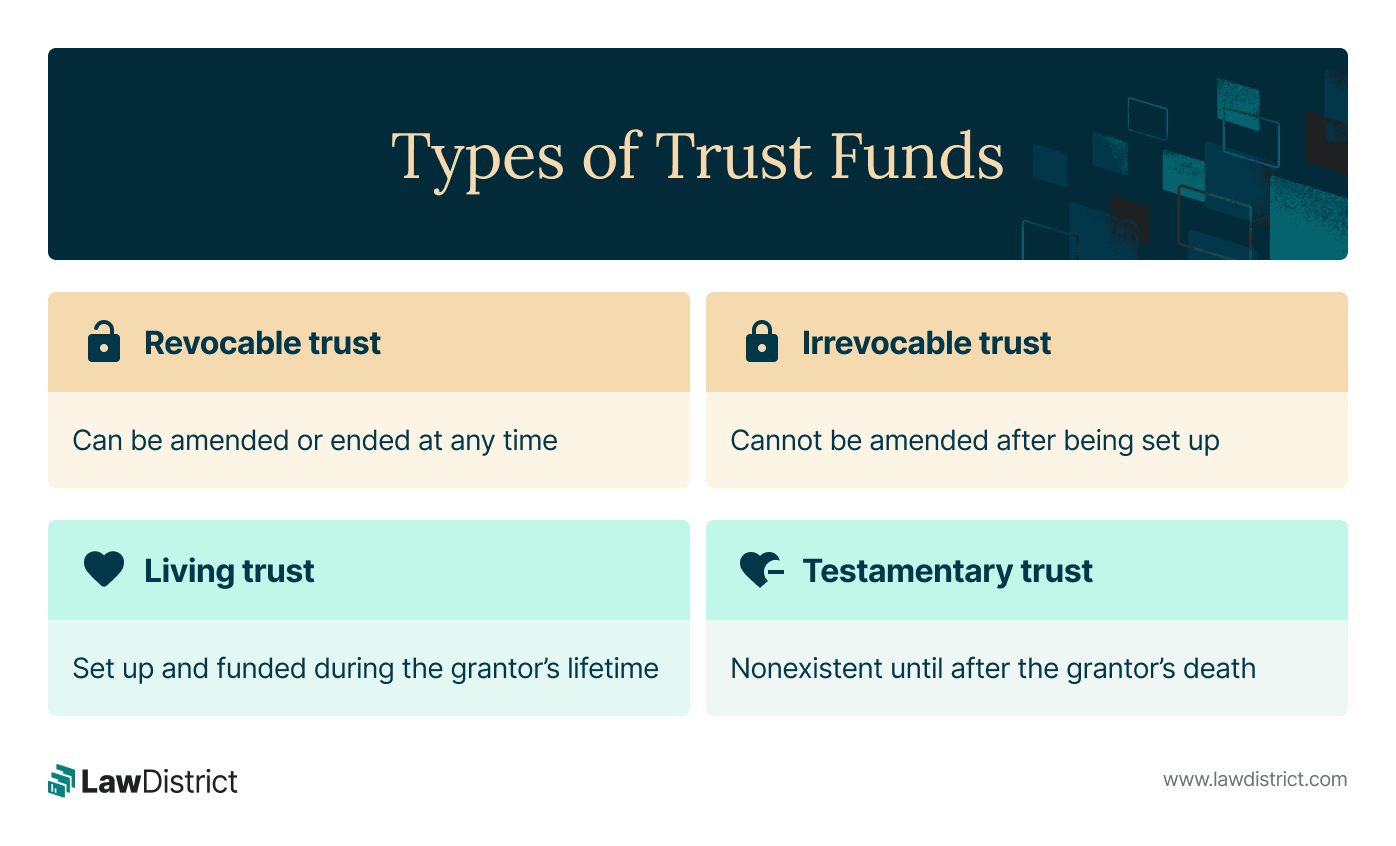

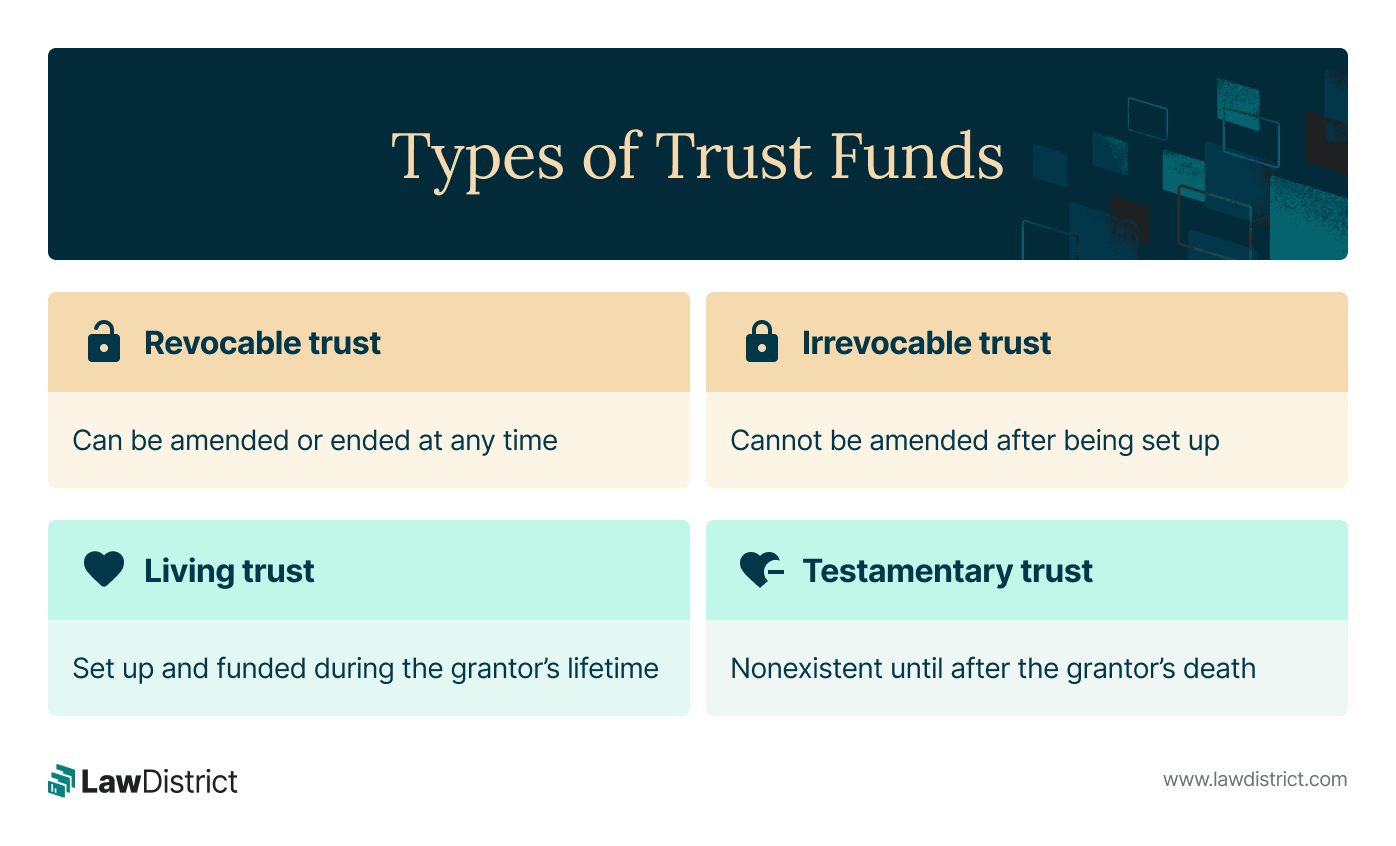

A trust can be revocable or irrevocable, as well as living or testamentary, depending on the terms and when the grantor sets it up.

Revocable trusts

Assets in a revocable trust continue in the grantor's control as long as they are alive. As with all trusts, the grantor places assets into a trust for a beneficiary. However, the grantor can amend or end it at any time. The funds in a revocable trust are available to a grantor's creditors.

Many people use revocable trusts to skip the public, costly, and sometimes lengthy probate process when they die. This type of trust fund also offers flexibility in case your priorities change.

Irrevocable trusts

Irrevocable trusts are so named because grantors cannot amend or revoke them once set up. The funds remain in the trustee's control until it is time for the beneficiary to access them. The grantor's creditors cannot access the funds because they are no longer their property.

The fact that it is so difficult to alter the terms of a revocable trust may make it unappealing. However, keeping assets out of creditors' and judgments' reach is a significant advantage.

Living trusts

A grantor can set up living trusts that are either revocable or irrevocable. For a trust to qualify as living, you must set it up and fund it in your lifetime.

Start your Living Trust now

Testamentary trusts

The conditions in a deceased person's will may trigger the formation of a trust. For example, a parent may state in their last will that a firm they own is trusted to cater to their son's needs. They may include conditions under which the son can access the funds; for example, they would have to keep a job.

Trusts only exist after you fund them. Therefore, a testamentary trust is nonexistent until the grantor dies, their will goes through probate, and assets go into the trust. The executor of the will would require a letter of testamentary to oversee the estate distribution.

As the next section explains, the type of trust fund you set up depends on why you need it and who the beneficiaries are.

Other Types of Trust Funds

You may set up a trust fund to benefit anyone—a child, a grandchild, or an organization. You may also use them to reduce or avoid excessive tax obligations. The following are types of trust funds that benefit different groups of people.

Special needs trust fund

You can place assets in a special needs trust to support a loved one living with special needs. The assets you put into the trust can help care for them long after you are gone. A special needs trust does not impede a person's right to receive disability benefits.

Generation-skipping trust

This trust transfers the contributed assets to grandchildren rather than the grantor's children. A person may also set up this type of trust to pass assets to a non-relative who is at least 37.5 years younger.

Before 1976, generation-skipping transfers did not face the additional estate taxes they would if the grantor had left the assets to their children. The government introduced GST —Generation-Skipping Transfer—taxes on these trusts to prevent abuse by wealthy families.

According to the American Taxpayers Relief Act of 2012 [1], however, there is a permanent $5 million exemption—meaning only assets in the trust above $5 million are taxable. Additionally, on December 22, 2017, then-President Donald Trump signed the Tax Cuts and Jobs Act that doubled tax exemptions through December 2025. The high threshold means most consumers may never pay taxes on these trusts.

A-B trusts

Married couples set up A-B joint trusts (or AB joint trusts) to protect their children's inheritance. The assets remain in a single trust while both parents are alive. However, if one spouse dies, the trust splits into two—the A and B trusts.

The A trust receives the surviving spouse's assets, while B (bypass trust) receives the deceased's assets, which go to the couple's children. The assets in the bypass trust are not subject to taxes. The surviving spouse must not overly benefit from them. Still, the remaining spouse can legally use the funds to generate income.

At the death of the remaining spouse, the assets in the bypass trust go to the children without a probate process. Bypass trusts are irrevocable.

Charitable trusts

These trusts allow grantors to keep giving to a charitable organization whose cause they support. You may set it up as a Charitable Lead Annuity Trust (CLAT) or a Charitable Remainder Annuity Trust (CRAT)

CLATs direct that funds from the trust go to the charitable organization for a designated time, after which the remainder goes to a beneficiary. A CRAT orders that a beneficiary receives income for a time. At the end of the set period, the remainder goes to the charitable organization. Placing your donations in a trust can result in tax deductions.

Spendthrift trusts

Grantors use spendthrift trusts to transfer money to loved ones with money management issues. In the trust's conditions, they may limit how much and often beneficiaries receive funds.

For example, the grantor may direct that a daughter gets only enough money every month for their needs. They may also require that the funds not be used to pay debts, thus limiting the beneficiary's access to unnecessary credit. State laws determine how long trusts should last.

The table below summarizes the advantages and disadvantages of trust funds.

| Advantages of Trust Funds

|

Disadvantages of Trust Funds

|

| Can skip the complications of the probate process

|

It may be costly to set up and pay a trustee

|

| They are private

|

Depending on the type, you may lose control of assets in a trust fund

|

| They offer better estate protection (the trustee has a fiduciary duty to act in the beneficiary's best interest)

|

You may need no transfer title ownership if assets include real estate

|

| The can reduce tax obligations

|

|

Word choice is crucial when setting up trusts. You can use a free living trust form to create your document. You can also generate a certificate of trust to prove the trust's existence.

Helpful Resources:

[1] H.R.8 - American Taxpayer Relief Act of 2012