KEY TAKEAWAYS

- Landlords looking for rental longevity may be more suited to traditional renting.

- Renting out a property provides a landlord with a consistent income via monthly rental payments.

- Airbnb can command higher rates, but some states restrict how long a property can be rented out. Similarly, Airbnb rental properties can sit vacant for months out of season.

Landlords, listen up! How often have you pondered the questions: Should I Airbnb my property or rent it the traditional way? How will I make the most return on my investment? Which option is best for me? Where will I get the best bang for my buck?

Suppose your goal is to regularly lease your property for short periods, for example as vacation rentals, or as layovers for people who need somewhere to live while waiting for a purchase to complete. In that case, the Airbnb model may have sprung to mind.

Though it may seem an attractive option — after all, Airbnb is only growing in popularity amongst guests looking for short-term rentals — how effective is it for landlords? On the other hand, if you’re looking for more permanent tenants, how lucrative is it for rentals on a longer-term basis, e.g. six months or more?

In this article, we will look at the differences between Airbnb and renting, including the pros and cons of each, so homeowners can make informed decisions about how they lease their properties.

What is the Difference Between Airbnb vs. Renting?

Airbnb typically tends to appeal to short-term rentals. Its main market is tourism, meaning properties are usually only rented for a short period, from a couple of days, weeks, or, at the most, three months.

Platforms like Airbnb act as the middleman between the landlord and the tenant. They charge a service fee for listing the property and marketing it on their huge, trusted platform — often, to prospective global guests.

In contrast, renting (especially longer-term), is advertised for those looking to set down roots for six months or more. These properties are seldom advertised on Airbnb-style websites and are instead listed on agency websites, or sites specifically dedicated to long-term rentals or sales, where tenants are required to sign legal lease agreements.

In addition, landlords have the right to collect rent from the tenants each month as opposed to up-front fees from short-term guests, who pay for their stay in one transaction.

Is Airbnb more Profitable than Renting?

The question ‘does Airbnb make more money than renting?’ is a difficult one. Because at first glance, you’d probably want to answer, ‘yes,’ simply because they can demand much higher rates than long-term renting.

It’s true that some properties — especially those in popular tourist destinations — can earn the same amount in one week as a long-term rental could make in one month. But, the stability is not there.

This is because you could also say that vacation lets have the capacity to sit empty for months making no money, while still requiring the landlord to make any necessary repairs, pay maintenance fees, and adhere to the host’s service charge. This is something we explore in depth later on.

According to Statista, the total revenue of Airbnb worldwide reached $9.92 billion in 2023. North America earned $4.6 billion of this figure and was also crowned as the region that brought in the highest amount of revenue.

Regarding renting, rental property website Azibo reported that as of 2024, United States landlords have an average annual income of around $60,107, proving consistent and lucrative earning potential. Of course, like Airbnb, the average income amount can differ depending on multiple factors, including property type, location, market condition, and rental prices.

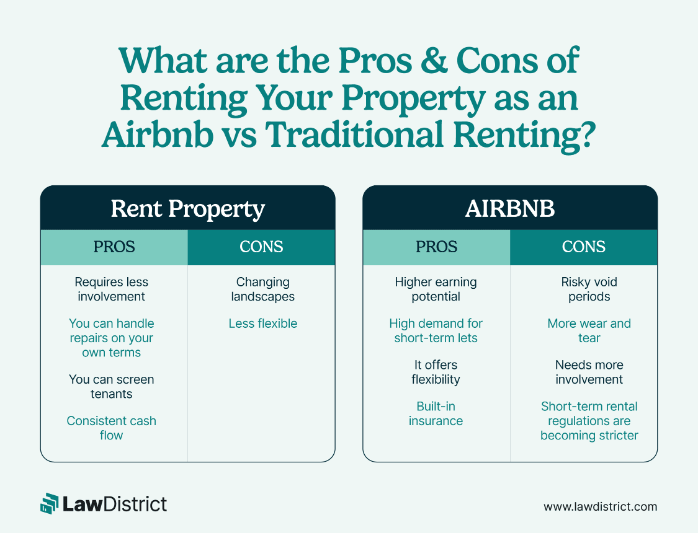

What are the Pros & Cons of Renting Out Your Property?

Considering long-term renting over the Airbnb model? Here are some of the pros that could swing your decision:

Requires less involvement

Unlike a vacation let, where landlords need to be constantly on-call in case of an emergency, long-term rentals generally require a lot less involvement. Granted, there’s more admin before the tenants move in, such as dealing with references, agreements, security deposit, etc.

But once all of this is done at the start, the theory is that it should be plain sailing from there. Plus, that landlords will rarely need to visit the property, other than for routine inspections, which typically take place every six months or so.

During these inspections, landlords will refer to the inventory they carried out at the start of the tenancy, and ensure that everything is how it should be. Then, they’re free to relax again for another six months.

You can handle repairs on your own terms

During a tenancy, there may be times when a tenant contacts a landlord in the event of an emergency, or if a repair needs completing. However, it’s up to the homeowner how they respond to the request.

For example, the majority of landlords prefer to take care of maintenance issues in-house or commission someone they know in the trade to keep costs down. For landlords willing to pay a little more for less responsibility, real estate agents will take on the property and deal with any problems on the homeowner’s behalf.

You can screen tenants

One of the biggest benefits of long-term renting over vacation lets is that landlords can screen prospective tenants.

From attending viewings and meeting them in person, to completing tenant referencing for credit and employment checks, and receiving references from previous landlords, homeowners can feel comfortable knowing their property will be looked after and the tenant can afford the rent.

Consistent cash flow

Arguably the most important benefit of long-term rentals is that landlords can guarantee a consistent cash flow. Renters are required to sign a lease agreement, which details the monthly rent amount, where they agree to pay it on time each month. The longer the lease, the more stable your income will be.

What are the cons of renting out your property?

Nothing’s perfect, and longer-term rentals do have some disadvantages, too. These include:

Changing landscapes

Due to the pandemic, many people are now able to work from home, (see: anywhere), meaning travel is on the up. The McKinsey’s American Opportunity Survey reported that 58% of respondents have access to some type of remote work. Plus, Localyze revealed that America has the largest population of digital nomads, with 17 million in total.

For this generation, it’s easy to see how short-term rentals available through sites like Airbnb are very attractive.

Additionally, Yahoo Finance shared some stark figures surrounding COVID-19 and the impact it had on people’s finances. The data revealed that 80% of Americans are still struggling financially four years after the pandemic.

Such a major life shift has left many wary about entering long-term leases as they try and recover from their financial losses.

Less flexible

For landlords, the certainty of a long-term lease can provide financial peace of mind. However, as we said above, some tenants don’t like being locked into lengthy contracts, be it for money worries or that they might not be sticking around in the area for long.

What are the Pros & Cons of Renting Your Property as an Airbnb?

Now for some Airbnb pros:

Higher earning potential

Vacation lets have the potential to be monster earners because landlords can command much higher rates than long-term rentals. As we said earlier, properties located in tourist or desirable areas can make a whole month’s rent in one week — often with the scope to earn more during tourist seasons.

High demand for short-term lets

There’ll always be demand for holiday lets, especially in the high seasons, meaning landlords with properties in tourist locations can always guarantee an income during this time. But alongside vacations, short-term rentals can also cater to many other occasions such as business trips, digital nomads, and even stag and hen parties.

It offers flexibility

Landlords with short-term lets are very appealing to tenants looking for flexibility. Whether it’s easily extending their stay or serving notice without requirement, for many, this freedom is non-negotiable. Plus,homeowners also have more flexibility to use the property themselves or give friends and family first choice.

Built-in insurance

Airbnb vs long-term rental have very different types of insurance policies. Vacation rental platforms usually have a ‘host guarantee,’ which means landlords are financially covered in the event of property damages.

What are the Cons of Renting Out Your Property via Airbnb?

Now it’s time to weigh up Airbnb vs renting out with the cons:

Risky void periods

Outside of the high tourist seasons,landlords run the risk of not making any money on their property. Without regular bookings, it could sit vacant for months, but homeowners will still be required to pay for upkeep, service charges, and mortgage repayments.

On top of this,cancellations can be a problem too, as guests have the right to cancel last-minute. Not only will this strip away your earnings, but it’s also unlikely that someone else will book the property at such short notice.

More wear and tear

Even if your property has a constant flow of bookings, the building will be more susceptible to wear, tear, and general damage. This will likely increase your maintenance costs, regardless of whether you manage the property yourself.

If this is the case, it’ll also be more time-consuming. Furthermore, when guests are paying higher rates for vacation rentals, they expect a clean and functioning property.

More involvement

It’s common knowledge that Airbnb hosts have to be more involved with their guests, as usually, they’ve booked it as a vacation let. This means landlords will need to constantly be on call to answer requests, meet the guests to hand over and collect the keys, and share the property location details.

If it’s a busy season, chances are, landlords can’t take trips like longer-term rental homeowners can. Additionally, Airbnb and similar platforms do provide some protections regarding claims or losses, but they are at the discretion of the hosting website. It’s advisable to check these policies as they may not lean in your favor.

Short-term rental regulations are becoming stricter

As short-term rental laws vary from state to state, landlords must research the regulations that apply to them. For example, if your city allows short-term rentals, you might have to apply for a permit, which could incur bigger costs.

Landlords may also have to request short-term rental permission from the Homeowners Association (HOA) if the property is in a gated community or apartment complex.

According to Homeowners Protection Bureau, LLC (HOPB), this is because ‘vacation renters tend to be messier and noisier, especially at night, than permanent residents.’

Elsewhere, HOPB states that ‘vacationers do not pay HOA fees and are less vested in the long-term condition of the community.’

There are absolutely zero loopholes here, either, and landlords who get caught are susceptible to receiving a fine. In more serious cases, legal action could be taken. For example, this happened to another vacation rental site, Vrbo in March 2022.

The company was sued by the city of Los Angeles for not complying with rental laws. This included allowing hosts to profit from the platform without registering under the city's short-term rental ordinance.

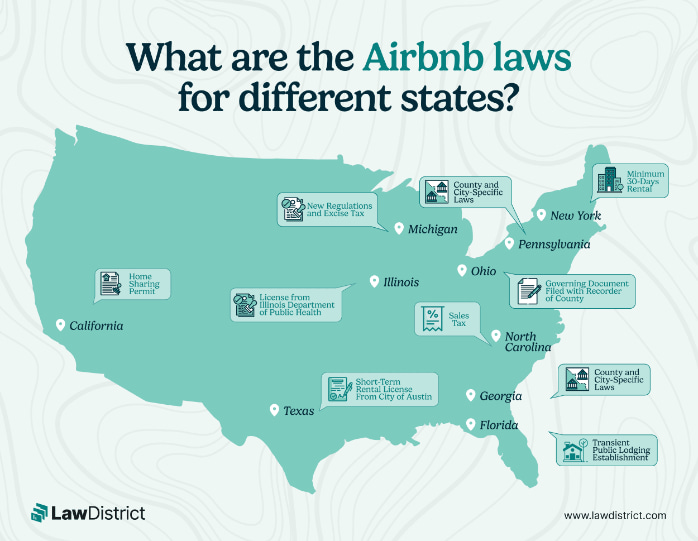

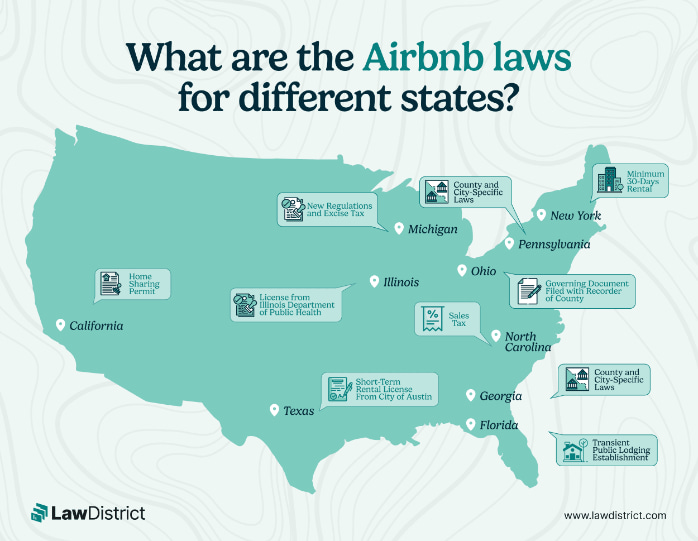

What are the Airbnb Laws for Different States?

| California

|

According to Hostaway, Airbnb hosts must ‘obtain a home-sharing permit and renew it annually.’ Those who want to host for longer need to apply for extended home-sharing. ‘The city’s zoning laws also severely restrict vacation rentals in its residential zones.’

|

| Texas

|

Airbnb states that Texas hosts - particularly in Austin - should obtain a short-term rental license from the City of Austin. The City of Austin also defines an STR as the rental of a residential unit or accessory building for less than 30 consecutive days.

|

| Florida

|

Under Florida law, vacation rental is defined as: ‘any unit or group of units in a condominium or cooperative or any individually or collectively owned single-family, two-family, or four-family house or dwelling unit that is also a transient public lodging establishment but that is not a timeshare project.’

|

| New York

|

In September 2023, New York enforced a 2022 law that banned people from renting their homes for fewer than 30 days (unless the host stayed in the home with guests).

|

| Pennsylvania

|

According to Hostaway, Pennsylvania does not impose Airbnb laws and regulations governing the whole state, apart from taxes. Instead, they are county and city-specific. For example, in Philadelphia, when you rent a property or unit that is not your primary residence, you need a Rental License. They must be renewed annually.

|

| Illinois

|

Hostaway states that if you plan to rent two or more units in a building that has at least four units, e.g. condos or apartment buildings, landlords need a license from the Illinois Department of Public Health. But, if you are renting space in your own home for up to 30 consecutive days, you don’t need a license. But you will need to register with the state.

|

| Ohio

|

Chapter 5323 of the Ohio Revised Code requires "residential rental property" to be registered with the county auditor in certain circumstances. For example, in terms of condominiums and planned communities, landlords need to have governing documents filed with the recorder of the county in which they are located.

|

| Georgia

|

Georgia does not have any state-wide regulations for short-term rentals. Rather, it has laws specific to counties and cities. For example, in March 2021, the City of Atlanta adopted the “City of Atlanta Short-Term Rental Ordinance.” Airbnb says the Ordiances ‘states that a short-term rental license may be obtained by a short-term rental owner, or long-term tenant of a short-term rental, for their primary residence plus one additional dwelling unit without any additional requirements, fees, permits, licenses, zoning, or related restrictions. The Ordinance requires owners to apply for a STR license through an online portal developed by the City.’

|

| North Carolina

|

Airbnb writes that guests who book listings in North Carolina must pay the North Carolina Sales Tax, which is 6.75-7.5% of the listing price ‘including any cleaning and guest fees for reservations less than 90 nights.’ North Carolina also imposes both a statewide 4.75% tax and a local 2-2.75% tax, which varies by county. Additionally, guests are required to pay City and/or County Occupancy Tax. This varies by city, but is ‘typically 1-8% of the listing price including any cleaning and guest fees for reservations less than 90 nights.’ More information can be found on North Carolina's website.

|

| Michigan

|

Michigan Public states that a series of bills in the Michigan House of Representatives would introduce new regulations on short-term rentals. For example, landlords renting through platforms like Airbnb and Vrbo would be required to pay a new 6% excise tax, on top of the existing 6% use tax.

|

Main Considerations for Landlords Debating Between Renting and Airbnb

Airbnb vs renting out a property is very much a hot topic. Considering Airbnb’s colossal turnover in 2023, it’s no surprise that many landlords with properties in tourist locations seriously contemplate the option. However, it’s probably only worth it for landlords who are happy to take risks and can afford their outgoings during dry letting spells.

On the other hand, it seems that long-term renting is also on the rise, as VRM Intel reported that 45% of investment property buyers purchased investment property to generate income through renting over flipping.

Because short-term rentals don’t offer the consistent cash flow as longer-term tenancies — even though some months could generate plenty — is the risk worth it?

As a landlord, it’s imperative you weigh up your options and do your research to ensure the decision you make can yield you the best profit.

Is Renting More Sustainable than the Airbnb Model?

Essentially, the Airbnb business model is based on a two-sided marketplace that serves both property owners and guests. Airbnb charges a service fee from both the guests and the property owners for each booking.

Rental properties charged fixed rents

A rental lease agreement charges a monthly (sometimes weekly) fixed rent from the occupiers for an agreed initial term period which can normally be extended if required.

Airbnb can be restrictive

As noted, Airbnb is primarily designed for short-term visits and hosts normally restrict them to a one-month or up to three-month maximum term.

Airbnb options are obviously not sustainable if the property is required for longer periods (as the primary residence) for the occupiers who may be able to arrange a more flexible assured shorthold tenancy of three, six, nine, or 12 months, or an indefinite tenancy period.

If the individual is traveling on business/leisure visits requiring one to three months stay, it would make sense to think about Airbnb rather than a traditional renting arrangement.

As well as flexibility, Airbnb is good for the environment, supports the local economy, and lets you make personalized greener choices e.g Airbnb properties often use smart technology like smart thermostats and energy-efficient appliances for precision control over energy consumption.

Many are also conscious of their carbon footprint and now use biodegradable toiletries, organic linens, etc. That being said, rental landlords can be just as green in a variety of these areas.

Rental properties can be sub-letted

In terms of short-term visits, landlords opting for the old-fashioned renting model can sub-let or sub-lease their units, if the property has enough space.

But, always note that sub-letting a mortgaged property requires permission from the lender. It’s also worth drawing up a roommate-tenant agreement if you, the homeowner, plan to sublet the property while living there.

Yet, despite the benefits of Airbnb,the traditional renting route is still more revered and sustainable, providing all landlords adhere to a properly regulated framework for the correct management of properties.

Helpful Resources:

Airbnb - Statista.com

Worst Airbnb Fees - Forbes

Worldwide Airbnb Revenue - Statista.

American Opportunity Survey - Mckinsey